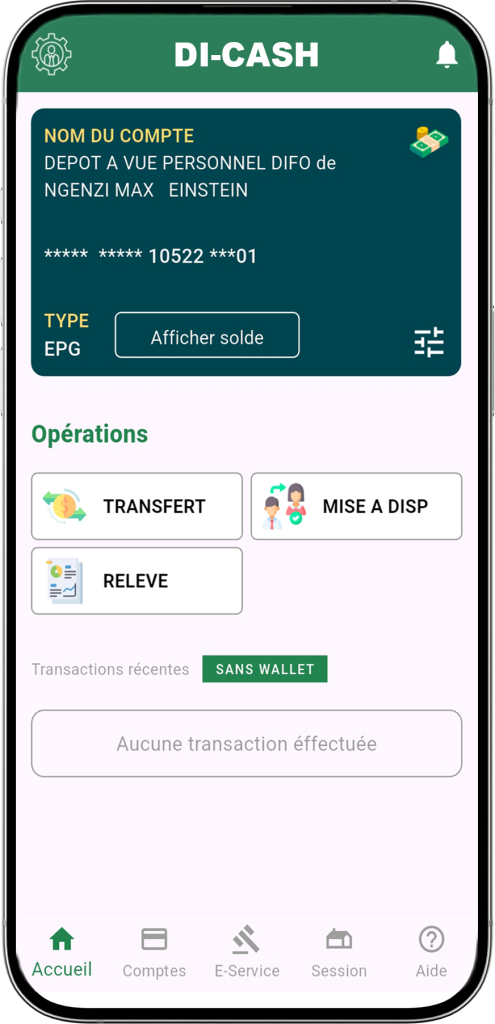

Stay on top of your finances wherever you go with DI-Cash

One place for all your digital financial needs and advanced payment solutions.

Online Advancement for Rural Business Owners

Empowering Growth Through Digital Financial Inclusion

About DIFO S.A

DIFO MICROFINANCE S.A

DIFO SA is a limited company created in 2010 and approved by the BRB under the 2nd category (as a Microfinance Institution) and whose main objective is to provide quality banking services easily accessible to small and medium-sized enterprises, to different economic groups and to the low-income population.

Currently DIFO SA provides financial and non-financial services to more than 18, 481 customers and disadvantaged households in Burundi focusing on low-income households without assets, working in the informal sector (and / or rural) to improve their level of life. In addition to all these financial services, he also focuses on their social, educational, skill development and many other things thanks to his 5 fully operational points of service with well-trained human resources and a strong, enthusiastic and young management team that gives them the opportunity to provide the highest quality financial services to their clients.

MISSION

Deliver financial services for all publics in general and in particular for the economically active poor in the margins of the traditional sector, from rural and urban areas, by making them closer and accessible to the target populations in order to contribute to the fight against poverty in Burundi.

VISION

To be the leader of microfinance institutions in the sense of innovation, quality of services and commitment to contribute to the economic and social well-being of local people and communities for the sustainable development of Burundi.

OUR PRODUCTS

Savings & Deposits

At DIFO, we offer a variety of Savings Accounts to help you save and manage your money better. Our savings accounts are easy to open and operate regardless of your location through our branch network

Loans

DIFO offers a variety of loan products specifically designed for individuals running micro, small and medium enterprises. A comprehensive research is conducted prior to each product’s introduction. The processes and procedures are also tailored and customized according to our clientele requirements, bringing convenient credit facilities to our customers.

DOWNLOAD OUR APP

Launch your first transaction using these quick and easy steps

The DI-Cash App provides an easy and secure way to access your account, send money, withdraw cash, access to loans allowing customers to borrow loans on the App

Sign in your Account

Enter the required details to access your account.

Fund your account

Gain access to your account to initiate transfers, make withdrawals, apply for loans, and explore additional services.

Pay the vendor

Buy and pay anytime, anywhere

Open an account and find more ways to streamline your payments and other transactions.

Security. That’s DI-Cash.

Handle your finances safely no matter where you are. Reach your funds anytime, anywhere.

Smart way to be quicker.

Worry less about your finances. It’s simpler than you expect to reach your account anytime, anywhere.

DI-Cash accessible to all.

Handle your finances safely no matter where you are. Reach your funds anytime, anywhere.

GET DI-CASH ON ALL YOUR DEVICES

Mobile App

Get the DI-Cash app today and enjoy limitless transactions.

Available now on the Play Store and App Store.

Desktop

We’re always offering more. Our web app expands your workspace and is compatible with all major operating systems and browsers.

USSD

Internet access isn’t required. Dial *163# via your mobile network to securely manage your account.

SOME FACTS AS OF DECEMBER 31, 2021

PRINCIPLES

PARTNERS

Feedback

Hear What Our Clients Say About Us

"DIFO S.A is important to us because, as coffee farmer, we face money problems due to the fact that we have to wait for the harvest and then the sale and DIFO S.A allows us to face it by granting us advances on wages on presentation of the promissory notes provided by the coffee office or by granting us loans which we repay with money from the sale of coffee.

The loans contracted with DIFO S.A allowed me to renovate my house, increase my harvest and meet the different needs of my family"

"From the time I received my salary directly from the Burundi Tea Office, I was in a difficult situation, which did not allow me to carry out my projects. Although the Burundi Tea Office gives us our wages on time, there was not a fund to provide us with loans, which meant that I was still indebted to individuals, which to give me a debt, asked for high interest.

DIFO has allowed me to be more respected by my entourage because now I am not always borrowing money from them. Even now they are the ones thinking about borrowing me money."

"Before the arrival of DIFO S.A, one could spend a month or two with promissory notes from the sale of tea but nowhere to trade them for money. As a result, when faced with a problem such as a sick woman or child or the payment of fees, we had recourse to loans from merchants which requested an interest between 30 and 40%.

The arrival of DIFO S.A was like a providence for us. Life has become easier, when faced with a concern, DIFO SA gives us an overdraft with an acceptable rate."

"Before DIFO S.A, I was a member of COPEC Microfinance. It was then that I became aware of the existence of DIFO S.A, the time of processing their loans, the way they grant them without problem and without forgetting the way they take the time to listen to you. It was after that I decided to become a member of DIFO S.A.

DIFO S.A allowed me to blossom by giving me my first loan and I know they will be there the next time I need a loan."

24/7 Availability

We Are Available For Services

Our dedicated team is here to assist you with any inquiries you may have regarding our products, services, or your account.